Accounts payable departments play an important role in maintaining a company’s financial health. They make sure that invoices are paid on time, vendors are satisfied, and financial records are accurate and up-to-date. In reality though, this is often easier said than done. It’s not uncommon to run into issues such as late payments, inaccurate reporting, fraud, etc. Preventing these scenarios requires effective organization.

And since you’re here, you must be looking for ways to better organize AP. In this blog post, we’ll discuss how to organize accounts payable invoices in 2025 and beyond. Keep reading to find out how you can streamline invoice processing, keep accurate records, and ensure financial transparency and efficiency. You will also learn how Docparser can help you accomplish these goals.

Process Invoices Faster & Easier With Data Extraction

No more data entry. Upload your invoices to Docparser and get structured, accurate data.

No credit card required.

The Challenges of Invoice Processing

AP departments often deal with not just one, but multiple challenges at the same time. Identifying these challenges is necessary in order to devise a plan to overcome them. The most common invoice processing challenges are:

- Manual data entry: ask any person in AP and they will tell you how time-consuming and error-prone manual data entry is. From typos to duplication and misclassification, human error jeopardizes the accuracy of financial records.

- Paper-based systems: paper invoices can be lost, damaged, or misplaced. This causes processing delays, duplicate payments, and other inefficiencies.

- Lack of standardization: in the absence of standardized procedures, people will process invoices in different ways, leading to confusion, delays, and mistakes across departments or locations. Dealing with these situations can be very frustrating, complex, or stressful.

- Compliance issues: Ensuring compliance with regulatory requirements, internal policies, and contractual agreements adds another layer of complexity to invoice processing. Failing to do so results in penalties, fines, and damaged vendor relationships.

- Communication gaps: delays in communicating invoice status, payment terms, or discrepancies can lead to payment delays, misunderstandings, and extra costs. This will hurt your bottom line and reputation with vendors.

Chances are your AP department has run into some of these challenges before and may even still be grappling with it. If that’s the case, you need to implement some accounts payable best practices to improve overall organization.

How to Organize Accounts Payable Invoices

1. Standardize AP processes

Consistency is crucial for AP operations, hence the importance of standardization in AP and strategies for implementation. Specifically, you want to do the following:

- Establish clear, documented procedures that outline each step of the AP workflow, including invoice receipt, validation, approval, and payment.

- Define clear roles and responsibilities for AP tasks to ensure accountability (e.g. who authorizes payments?).

- Implement a standard naming convention for invoice files to make it easy to find and organize invoices.

- Define payment terms with vendors to establish clear expectations and streamline the payment process.

- Train staff members involved in AP processes to make sure everyone adheres to the standardized procedures and best practices.

In addition to speeding up invoice processing, standardizing processes also helps your AP team avoid errors, redundancies, and discrepancies.

2. Centralize invoice payments

If you haven’t already, you should consolidate all payment activities into a unified system. Centralizing invoice payments helps you better track invoices, streamline processing, improve visibility on spending, and control access to sensitive financial information.

Furthermore, a centralized AP system allows your organization to negotiate volume discounts and better rates with vendors. This is particularly useful if your business has multiple locations. Each one will benefit from company-wide terms instead of handling negotiation on their own, leading to significant cost savings.

3. Conduct periodic audits

Audits aim to verify the legitimacy, accuracy, and compliance of invoice records and payment transactions. Conducting periodic audits allows the AP department to identify errors, discrepancies, potential fraud or theft, as well as areas of improvement.

After planning an audit, auditors perform the fieldwork. They will organize and then review invoices, purchase orders, receipts, and contracts. Auditors will also reconcile the ledger with vendor statements and analyze AP procedures. An audit report is made afterwards, where auditors will summarize their findings and recommendations.

4. Communicate with vendors

Effective communication with your vendors allows you to avoid misunderstandings, delays, or other issues. For example, in B2C industries, delays in procurement cause delays in order delivery, thus compromising customer satisfaction.

So be sure to provide clear payment instructions and open multiple communication channels, from email to phone, video, and in-person meetings. Also, be proactive in your communication. For instance, if your business runs into cash flow issues, make sure to notify your vendor as soon as possible so they can plan accordingly. Furthermore, always try to resolve issues or conflicts amicably and promptly. By doing all of this, you foster a win-win relationship with your vendor. You will enjoy reliable procurement,

5. Automate low-value tasks

Low-value tasks, mainly data entry, cost a lot of time and are prone to errors. From vendor information to line items, there is a lot of data in every invoice that needs to be keyed in. Since the volume of invoices you receive will only keep increasing as your business grows, you might as well invest in accounts payable automation to eliminate the troubles of manual work.

Specifically, you should automate data entry to save time, streamline invoice processing, and improve data accuracy and consistency. As you can imagine, this makes the organization of invoices much smoother.

To do that, Docparser is exactly what you need. Businesses use it to extract data from invoices into their systems seamlessly and without errors.

Process Invoices Faster & Easier With Data Extraction

No more data entry. Upload your invoices to Docparser and get structured, accurate data.

No credit card required.

Why You Should Automate Data Entry With Docparser

User-friendly

Your AP doesn’t want to dedicate time and effort to start using a new piece of software — and understandably so. Luckily, Docparser doesn’t require to be downloaded and installed. You just log in from your browser and start using it. Furthermore, there is no need for users to have any technical knowledge. To set up Docparser to extract data from invoices, you just have to do the following:- Upload a sample invoice

- Create parsing rules — one for each data field (invoice number, vendor name, line items, etc.). You do this on an intuitive point-and-click interface that gives you instructions along the way.

- Define the output format you want (download as an Excel file, export data to QuickBooks Online, etc.)

“Docparser is a great tool to save time, reduce human data entry mistakes, and automate low-value tasks for a company. Its really user-friendly interface and the default rules and filters are very well designed. They allow you, basically, to do whatever you want to extract data from your documents. We use it specifically for invoice data capturing (AP) and it’s working perfectly and very fast.”

Save time and costs

The two biggest advantages of using Docpaser to automate data entry are saving time and money. By cutting down hours of tedious work to just a few minutes of invoice processing, you save the cost of that manual work. Employees can then dedicate their time to higher-value tasks like cash flow management, negotiating better deals, strategic planning, etc. There is also the cost of human error which you will be able to prevent by using Docparser. Data entry mistakes incur a lot of extra costs, from spending time finding and rectifying errors to late payment fees, overdrafts, and so on. But once you build a parser capable of extracting invoice data with complete accuracy, you won’t have to worry about these issues again.

There is also the cost of human error which you will be able to prevent by using Docparser. Data entry mistakes incur a lot of extra costs, from spending time finding and rectifying errors to late payment fees, overdrafts, and so on. But once you build a parser capable of extracting invoice data with complete accuracy, you won’t have to worry about these issues again.

Docparser easily fits into your workflows

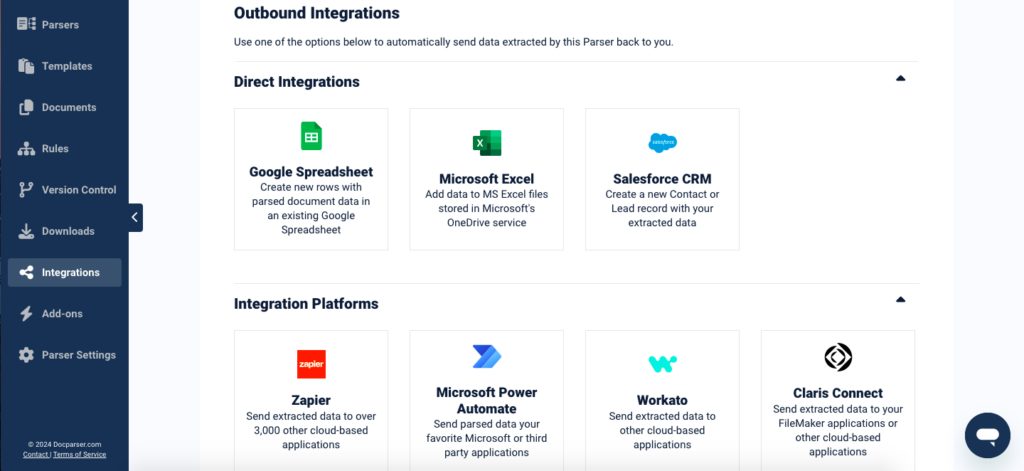

Last but not least, Docparser is designed for the modern cloud stack. If you use a cloud-based accounting system, you can easily set up an integration to send parsed data there. In addition to native integrations, you can use a third-party platform (like Zapier) as an intermediary between Docparser and your preferred cloud app. You can even send data to any HTTP(S) endpoint in real time. Feel free to explore our integrations here. Moreover, you can always ask us for help and we’ll be happy to set up your custom invoice parser for you.

Feel free to explore our integrations here. Moreover, you can always ask us for help and we’ll be happy to set up your custom invoice parser for you. To organize AP invoices, you should standardize your AP processes, centralize invoice payments in one system, conduct periodic audits to detect discrepancies and potentially fraud, improve communication with vendors, and automate data entry.

The four functions of accounts payable are invoice processing (includes invoice receipt, processing, and approval), invoice payment, account reconciliation, and vendor relationship management.

Accounts payable best practices include (but are not limited to): prioritizing invoices with the closest due dates, establishing access restrictions and internal controls, renegotiating payment terms, timely account reconciliation, and using automation to streamline workflows.

In Conclusion

We discussed in this blog post how to organize accounts payable invoices in 2025 and beyond. The five recommendations we provided — standardize AP processes, centralize invoice payments, conduct periodic audits, communicate with vendors, and automate low-value tasks — are not exhaustive, but applying them will definitely improve your invoice organization a lot. You will streamline processes, prevent mistakes and bottlenecks, and improve your ability to negotiate better deals thanks to enhanced vendor relationships. You must try convert fidelity investments statements to excel with docparser.

Accurate and timely data is the foundation for accounts payable excellency. This is where Docparser comes in, as it helps you capture data from invoices and move it to your system. Docparser sets the stage for optimizing your AP workflows, reducing costs, and improving operational efficiency in managing accounts payable invoices. Get started today with a free trial today and discover the power of automated data capture.

Process Invoices Faster & Easier With Data Extraction

No more data entry. Upload your invoices to Docparser and get structured, accurate data.

No credit card required.