The Acord 126 is a widely used form in the insurance industry for collecting underwriting information. Agents, brokers, and underwriting teams fill it out on behalf of clients to issue general liability insurance coverage. If you work with this kind of form, you know the drill: collect data, double-check for accuracy, and input it into your systems. When you have dozens — if not hundreds — of forms to process manually, you’re looking at a productivity bottleneck.

Thankfully, there’s a better way — as the title of this blog post says. As it turns out, you don’t have to keep struggling with manual data entry. You can simply automate your Acord 126 processing with the right tool. Keep reading to find out how to do this with Docparser.

Capture Key Data from Your Acord 126 Forms Easily

Use Docparser to automate data entry, save time, and streamline your document-based workflows.

No credit card required.

What Is Acord 126?

The name Acord is an acronym that stands for Association for Cooperative Operations Research and Development. ACORD is a nonprofit organization that aims to standardize the flow of information in insurance to facilitate accurate data exchange and efficient workflows. So, the Acord 126 form, also known as the Commercial General Liability Section, is a standardized form used in insurance to collect and share key information about a business’s liability coverage needs. It typically includes:- Business operations and locations

- Limits of liability requested

- Coverage options

- Loss history

Insurance policies typically cover incidents such as bodily injury, property damage, medical payments, personal and advertising injury, etc.

Insurance policies typically cover incidents such as bodily injury, property damage, medical payments, personal and advertising injury, etc.

Who uses Acord 126?

The Acord 126 form is used by:- Insurance agents and brokers, who gather business and coverage details from clients.

- Underwriters, who assess risk and determine coverage terms.

- Business owners, who are seeking general liability insurance for operations, property, or services.

Why is it needed?

The Acord 126 is essential for several reasons. Using it helps accomplish the following:- Help business owners understand their insurance policy’s coverage and limits

- Protect owners and employees against liabilities and financial losses resulting from incidents

- Ensure businesses stay compliant with industry standards and regulations

- Provide evidence in the event of a legal dispute

- Ensure efficient claim processing

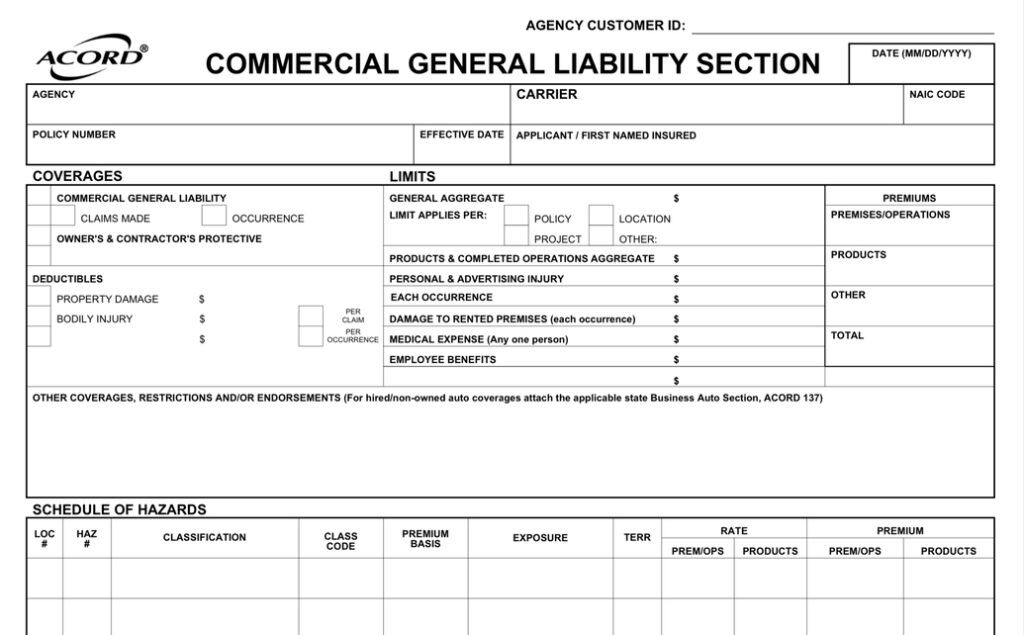

What to Fill Out In an Acord 126 Form

Let’s quickly go over the major sections that you need to fill out in an Acord 126 document:- General Liability Coverages: specifies the coverages the insured is applying for and includes the policy limits.

- Schedule of Hazards: a description of your business operations that is used to assess the risk level and calculate the premium.

- Claims Made: this section is filled out when the insured chooses a claims-made general liability policy, which means they must report an incident that occurred during the policy period in order for it to be covered.

- Employee Benefits Liability: this section protects employees from financial losses caused by mistakes or omissions from the company’s employee benefits program.

- Contractors: a set of questions that contractors need to answer.

- Products / Completed Operations: this section covers potential liabilities arising from the use of the business’s products or services

- Additional Interest/Certificate Recipient: here you can add one additional insured to be covered under the policy, like a customer, a vendor, etc.

- General Information: a series of questions that help the insurance provider assess potential risks and determine the coverage and premiums accordingly.

- Remarks: reserved for additional information.

- Signature.

But here’s the thing…

After completing the form, insurance agents often need to re-enter the information into business software to keep records, manage documents, track policies, etc. This could be an AMS (Agency Management System) or an underwriting platform. So, problems may arise when agents have a lot of Acord 126 documents to process or make mistakes while inputting data manually. This can lead to a lot of stress, delays in client response, and unnecessary extra work. But you already know the solution.Enter Automation, the Path for Faster Processing

Instead of spending hours entering data and double-checking for errors, you can simply extract it using a data extraction tool and then send it to your system. Automation tools have evolved a lot in recent years. They can process documents in minutes, identify the relevant data fields, and extract them without mistakes. Even better, tools that have added AI functionalities can better understand information to parse it accurately. For Acord 126 processing, you’ll need a solution that includes:

For Acord 126 processing, you’ll need a solution that includes:

- Customizable parsing rules to get accurate results

- OCR capabilities to extract information from scanned Accord 126 documents

- Handwriting recognition to extract handwritten notes

- Checkbox data extraction to recognize and extract checkbox selections

Capture Key Data from Your Documents Easily

Use Docparser to automate data entry, save time, and streamline your document-based workflows.

No credit card required.

Benefits of Automating Acord 126 Processing

Automating your Acord 126 processing workflow will transform your operations from a slow, manual grind to a fast, reliable system that scales effortlessly. Here’s how:Record Acord 126 forms faster

With automation in place, there’s no need to copy and paste data manually into your AMS. Just parse key fields like business name, coverage limits, and loss history in a snap. This way, you can process dozens (or even hundreds) of forms in a fraction of the time you would traditionally spend doing it.Prevent mistakes

Manual data entry leaves room for human error, especially when dealing with long or complex forms. When properly set up, a document processing solution can reliably extract information. This means fewer coverage issues, fewer rejections, and more confidence in your data.Enjoy more efficient workflows

After setting up your solution to process Acord 126 forms and move the parsed data to your AMS (or a similar system), you will quickly notice how seamlessly information flows from forms into your database. This will reduce turnaround times, allowing underwriters to review applications earlier and respond to agents and clients faster. Incidentally, if you happen to process the Acord 130 form (also known as the Workers Compensation Application form), you’ll be glad to know that we have an Acord 130 parsing template that you can use. Just upload your Acord 130 forms and the pre-built parsing rules will extract the data fields. So if this sounds like a major productivity boost for your insurance company, Docparser is the right tool to accomplish it.How Docparser Automates Acord 126 Processing for You

At Docparser, we make it simple to extract data from Acord 126 documents without writing a single line of code. Here’s how it works:- Create a Parser in Docparser (note: you can have multiple Parsers for different use cases).

- Upload a sample Acord 126.

- Create and customize Parsing Rules to extract each data field, whether it’s a text field, a figure, or a yes/no answer (with our Smart Checkboxes parsing feature).

- Add an integration to export the extracted data to the cloud app or API you use. Alternatively, you can download your data as a file in various formats.

- Enjoy your automated workflow! Whenever new forms are uploaded to Docparser, they get processed and the data is sent to your system.

In Conclusion

After implementing automated data extraction into your workflows, you will process Acord 126 forms much faster, eliminate mistakes, and deliver a smoother experience for your clients and underwriters alike. You can even go beyond Acord 126 forms and automate other data entry processes that cost you time and money. So Try Docparser for free and see how easy it is to streamline your insurance operations.Capture Key Data from Your Acord 126 Forms Easily

Use Docparser to automate data entry, save time, and streamline your document-based workflows.

No credit card required.