Tracking your transactions is essential to keep a clear picture of your business’ financial health. While you receive bank statements every month, you may want to keep your own statement for accounting and finance purposes. So if you are looking for a bank statement Excel template, you’ve come to the right place: we have a free template you can download and use.

This post will show you why you may need a bank statement template and what it should include. You will also find a link to download a free template to help track transactions faster and easier.

Why Use a Bank Statement Excel Template?

Banks typically issue a bank statement every month and will provide you with one whenever you request it. You may even download it directly from your bank’s client portal. So you might be wondering why one would use a bank statement template, especially since a template cannot serve as an official financial document. Well, there are various reasons you might want to use a bank statement template:

- Keep your monthly transactions organized and well presented

- Easily calculate amounts with formulas

- Reconcile your bank statements

- Find discrepancies and possible fraudulent transactions

- Prove that a transaction was made at a certain date

- Analyze your bank statement data with Excel or Google Sheets

- Upload your bank statement data to your accounting software

The last two points are particularly important. Imagine you want to analyze data for a long period of time – like a year, but it is scattered across a dozen documents with different structures.

Likewise, let’s say you want to analyze your transaction data with your software, but the data is locked within a PDF document or an image file. Uploading an Excel document that already contains that data will be much faster and easier than entering it manually.

For all these reasons, you should have an Excel template. And instead of creating a template from scratch, you can use a pre-built one – more on that further below.

Quick note: if you receive bank statements by email regularly, you can use Mailparser, the companion software to Docparser that focuses on extracting data from emails.

Why Use Excel for Your Template?

Excel is a fantastic tool for keeping financial records and has many advantages overall. It allows you to create formulas and functions that calculate amounts for you. You can also find data with filters and functions. While Excel has its limitations, it works great for something as simple as producing monthly statements.

Moreover, most accounting and financial software allow you to upload your financial documents in Excel format. The data inside will immediately become accessible from your software provided it’s structured properly. The same goes for Google Sheets as well.

How Does it Work?

After downloading our bank statement Excel template, you can start using it to record transactions and keep all the related data in one place, from dates to amounts and transaction descriptions.

Start by filling in details about your business (account number, business name, etc.). Then record your transactions, or simply extract them from your bank statements. From there, you can keep using your spreadsheet on Google Sheets to make it accessible to coworkers or upload it instead to your accounting system.

We have included a few formulas and functions to help you quickly calculate:

- The balance after each transaction

- Total deposits

- Total withdrawals

- The closing balance

If you add more rows to the table, make sure that all functions are still set up properly. We recommend not adding more rows after the last one. Instead, it’s best to insert them in the middle of the table. That way, functions are not affected and the total amounts will stay correct.

You can add a new sheet for every month or keep everything in one sheet. Also, you might find it useful to create graphs and charts that visualize data. It’s all up to you!

What Does This Excel Template Include?

You will find fields where you can enter the information typically contained in bank statements. Let’s go over them one by one:

Account Number and Name

This is self-explanatory – you write your account’s number and name. You only need to fill out this information once.

Business Information

Write your name, your business’ name, its address and phone number. If you run a sole proprietorship business, you can replace the business name with your own if you like. The purpose of filling out this section is that if you share your bank statement with someone, they will have access to and contact information.

Statement Period

This is the period covered by your statement. Write the date when the statement period starts and when it ends. Alternatively, you can just write the month and year instead of the date.

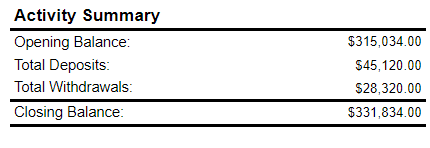

Activity Summary

The activity summary provides a quick view of your account’s overall situation. It includes:

- Opening balance

- Total deposits

- Total withdrawals

- Closing balance

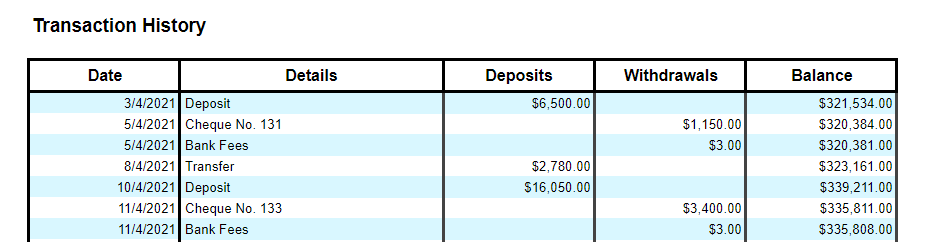

Transaction History

Also called Transaction Details or Transaction Summary, this table is the main section of your bank statement. It lists every transaction that took place during the statement period and specifies the following information:

- Date

- Details – a brief description of the transaction, check numbers, etc.

- Deposits (also called Debits or Receipts)

- Deposits

- Interests earned

- Withdrawals (also called Credits or Payments)

- Withdrawals

- Charges

- Penalties

- Balance

- Closing balance

You’ll find 20 rows in our template. You can add as many rows as you need to the table. Just check that the sum functions and balance formula are still properly set up.

Note that the table ends with the closing balance. The amount there should be equal to the closing balance’s amount in the activity summary.

Get Your Bank Statement Excel Template

Track your transactions with this free template. Please make a copy of the template prior to use.

You will find all the data fields we explained above along with simple formulas and functions that handle calculations for you. Open your copy, fill out your business details, and start recording transactions as you run your business.

Of course, feel free to customize your template however you like. Change the formatting, add your logo, add filters… edit to your heart’s content!

Need to Extract Data from Bank Statements? Try Docparser

Do you frequently enter bank statement data manually? If so, stop losing time on this tedious process and start extracting transaction and account details from your bank statements.

After grabbing your free Excel template, consider giving Docparser a try.

Docparser allows you to extract the data you want from your bank statements and download it in various formats as well as export it to a cloud application via a webhook. You get the data you need, structured and error-free, so you can immediately move on to more important tasks.

Interested? Sign up for a free account and start extracting bank statement data to save time and improve productivity.